The idea of this article evolved after my comment on an article at the Vtrender blog where Mr. RM Sharma responded by suggesting an ATR perspective a couple of weeks back. So, now lets gets to the ATR facts on longer duration time frame and its impact on intra day trading through my interpretation. Thanks RM, Shai, Kris, GD, Manu, Janak, Jigs, Sunita and all other friends at Vtrender. Here it goes :-

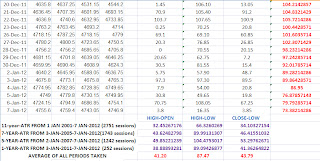

Explanation of the data columns in image uploaded :

Column G is High minus Open difference, column H is High-Low difference average, and column I is Close-Low average for the specified periods of 11-years, 7-years, 5, years, and previous 1 year.

INTERPRETATIONS:

1. On larger time frame it is clearly seen that trading is a 50:50 game between buyer and seller and not a zero-sum game. Getting the trade right is important as trading is just pocket science and not at all a rocket science. Some data base management skills is all it requires to do trading along with an appetite for taking calculated small risks. Having the correct data is vital.

2. The period between 2005-2008-2011 (7-years) was the best in terms of gains for long term investors as Nifty rose from 2100 levels to 6357 and falling and retracing back to those levels till 2010 November and again falling from January 2011.

3. The period between 2007-2011 (5-years) was the best in terms of trading as ATR wise average was at its peak during this phase 104 points which saw the bull run and retracement to same levels till 2010.

4. The last one year ATR has fallen which again proves that market goes up only when buyer sentiment is positive.

5. Now coming to gap up and gap down interpretations. The smoothened average across all time frames is 42 points from opening price, so technically any opening above 35-45 points above previous day close qualifies as gap up open and that open price remaining as the low for the day too makes it a changing trend day. Example: We had this scenario this Tuesday when Nifty opened gap up at 4675 and went on to make it a trend changing day. Interestingly, most of the trend changing days happen when the gap up open happens above the 5-EMA/-5-SMA levels. Hence the importance of 5-EMA/5-SMA level for intra day traders is very vital. Similarly, gap down below 35-45 points will technically qualify to be a gap down opening with the day’s high remaining at the open price. The most recent gap down happened on 19th December 2011 and Nifty fell to the year lows the next day. Again interestingly the 5-EMA/5-SMA level invariably gets breached on the way down on a gap down day. Another interesting observation is most of the gap down openings usually recover and gives opportunity to go long, while a gap up opening gives very little chance to think of short covering.

6. The opening of Nifty when upper circuit was hit on May 18, 2009 was actually a flat open @ 3673 and not a gap up. The fact is upper circuit on that day was due to the good news and buyers flocking to buy fresh and also short covering lead to that upper circuit. So, it is a misnomer when we read analysis that this gap up needs to be closed. There was no gap up then. Only a counter lower circuit will help achieve it.

PLAN FOR INTRA-DAY :

1) Every trading day the open level is important and there is always a likelihood of getting at least 20+ points from opening level with the simple condition that Nifty is above the 5-EMA/5-SMA level.

2) Any gap up open exactly above 5-EMA/SMA level invariably leads to big points for carrying positions overnight. My friends at Vtrender will vouch for this observation.

3) Intra day trading need not be done daily, but only when certain observations we are able to practice what we plan as according to me intra day trading is a 50:50 game. U can spend time studying the market 50% of the time and plotting your next move and u need to be in the market only 50% of the time and be stress free and disciplined.

4) So, simple formula for intra day longs is Day’s open +14-day ATR = Target. The 14-day ATR smoothens the volatility effectively in the market at optimum levels in a derivative composite index like Nifty and a good guidance level without thinking too much about a clutter of levels. Having a target always helps. One can always exit near to those levels even if exact level is not achieved. Even 7-day ATR or 21-day ATR can be used to arrive at price target levels. Being flexible in thought is important.

5) Another important observation is that Nifty takes U-turns from lows of the day and any level 45 points below close of previous day needs to be watched carefully for U-turn towards previous day closing value. The recent Friday, similar thing happened and more about it in next point. U-turn from previous day close – 45 points level is probable.

6) Intraday shorting can be considered only if there is one close below the 5-EMA/5-SMA level and there is negative news in abundance. Example: This past Friday even though intra day the 5-EMA/SMA level was breached the buyers sprung a surprise at 2:30 pm and took Nifty to 4794 even in bearish conditions. I see a fall now starting Monday if we fail to close above 4790 on Monday.

7) Above all, being honest with ourselves about our trade is very important. Trading is done to get the act right and earn and not to prove our view point right. The market humbles everyone at some point or other. Being extremely technical minded is important to control the emotional quotient and go by figures (trading levels) only J. Hope the readers of this blog find this stuff useful. Thanks once again for going through this article.

DISCLAIMER :

The above observations and presentation is made with the sole intention of helping only intra day trading and hope it is simple enough and readers are welcome to comment if they find it useful, informative, and helpful. The above observations pertain to Nifty only and need not necessarily work for other indices/stocks J