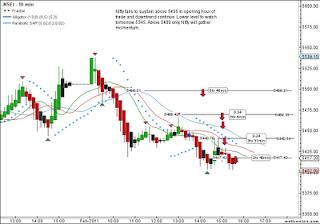

Nifty tests the 5-day LEMA level of 5413 and takes U-turn to once again go above 5-DEMA level and close firmly above 5500 levels today @ 5519. VWAP @ close is 5468.

1) This being February series expiry week, volatility will be high and lot of indecision in trader's mind with breach of 5-DEMA level twice in two days either side of this level. The bullish range for tomorrow is 5525 to 5555-5600 (Friday high).

2) Below 5525 level, Nifty will test 5420 levels once again and break of 5420 can lead to a more drastic fall to 5350 levels.

3) Trading will be largely range bound and highly volatile with rumours and lot of uncertain speculative news running up until budget. The market is clearly waiting for some more information regarding government's actions on JPC in various scams, probable budget impact, how inflation is addressed, etc. etc. One thing is certain, the Union budget will definitely provide a high dose of populist measures to soothen public perception of the government, but there will be hardly any deterrent action plan to tackle the single most problem the nation is facing - corruption. The PM himself admits that he can do little about the corrupt team he is leading and the constraints put on him by coalition politics/partners. So, the "aam aadmi" can only listen to the honest leader and take all that is happening in his/her stride and wait for the next election to find a lesser corrupt formation?

4) I will be taking a break from trading for the next fortnight and will be back on March 8th only with the daily trade plans. Till then, happy trading!